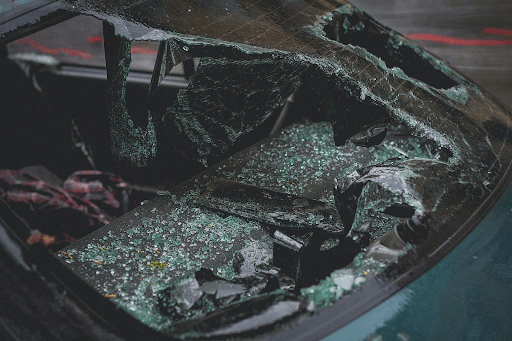

SR22 insurance isn’t a type of insurance in the traditional sense, but rather a certificate of responsibility. It’s a document that verifies a driver carries the necessary minimum auto insurance mandated by the state. Historically, the roads have been a place of both opportunity and peril. With the rapid increase of automobiles in the 20th century came a surge of accidents, often involving drivers who lacked adequate insurance or had a history of driving recklessly. There emerged a pressing need to identify and monitor such high-risk drivers to ensure they maintained the required insurance coverage. This growing concern led to the birth of the SR22 system; a mechanism to keep track of these drivers and guarantee that they held the appropriate insurance coverage. This article studies the deep-rooted history of SR22 insurance, charting its evolution from its earliest days to its current importance in our modern world.

Evolution of the SR22 System

The SR22 system, while a novel and necessary solution, wasn’t without its problems. Initially, there were hitches related to the seamless reporting and monitoring of high-risk drivers. Regulatory bodies grappled with standardizing the process, ensuring that every mandated driver had the certificate and that lapses in coverage were properly reported. The auto insurance industry, on its part, had to adapt quickly. Insurers were initially wary, given that the system required them to take on clients perceived as high risk. Over time, however, as processes were streamlined, many insurance companies began to see the value, tailoring specific policies for SR22 holders and integrating the certificate’s management into their systems.

Throughout the years, the SR22 system underwent various iterations. Legislative changes, technological advancements, and feedback loops from both the public and the industry led to more sophisticated tracking mechanisms, enhanced data-sharing, and an overall more refined process. The system, initially met with skepticism, evolved to become an integral component of the nation’s road safety measures.

Who Needs SR22 Insurance?

This certificate is mandated for drivers who’ve been identified as high-risk due to certain violations or a combination of them, ensuring they maintain state-required insurance coverage, such as SR22 in Texas or Arizona.

DUI or DWI Convictions

Driving under the influence (DUI) or driving while intoxicated (DWI) convictions are among the top reasons one might be required to obtain an SR22, as these infractions signify significant risk.

Serious Moving Violations

Violations, like reckless driving or causing an accident due to negligence, can necessitate an SR22 certificate, reflecting the driver’s potential danger on the road.

Repeated Traffic Offenses

Accumulation of minor offenses over a short period can lead to SR22 requirements, indicating a pattern of irresponsible driving behavior.

Driving Without Insurance Coverage

Being caught without valid insurance is a severe infraction, and the SR22 acts as a guarantee that the driver maintains continuous coverage thereafter.

The SR22 Process: From Suspension to Reinstatement

When a driver is mandated to obtain an SR22, it typically follows a suspension of their driving privileges due to one of the aforementioned infractions. To reinstate these privileges, the individual must first secure the required insurance and then have the insurer file the SR22 certificate with the state’s Department of Motor Vehicles (DMV). This certificate acts as proof of the driver’s continuous insurance coverage. However, the necessity for an SR22 often results in elevated auto insurance premiums, as insurers view SR22 holders as high-risk clients. The duration for which one is required to maintain an SR22 varies by state and offense but generally lasts between three to five years, contingent upon the driver not committing further violations.

Modern Day Relevance and Future Implications

Current statistics from the Department of Motor Vehicles (DMV) indicate that a significant number of drivers across various states still necessitate an SR22 certificate, a testament to its ongoing importance in ensuring road safety. Simultaneously, technological advancements are reshaping the landscape. Digital platforms and automation are streamlining the SR22 verification process, making it easier for both drivers and insurers to manage and monitor. As we look ahead, it’s plausible that further tech innovations could further refine or even redefine the SR22 system, aligning it more closely with the evolving demands of modern transportation.

The journey of SR22 insurance, from its inception to its present-day significance, highlights the evolving nature of road safety mechanisms and their enduring relevance. As it responds to the challenges of changing times, supported by technology, the SR22 system remains an indispensable tool in ensuring that high-risk drivers maintain accountability on the roads. Its continued evolution promises to align with the overarching goal of safeguarding both drivers and pedestrians in the dynamic landscape of modern transportation.